Safeguard your business against data breaches and cyber threats. Cyber liability insurance covers legal fees, customer notification, and recovery costs.

Cyber liability insurance provides businesses with essential coverage options to safeguard against data breaches and other cybersecurity threats. In today’s world, it's not a matter of if your company will face a cyber incident, but when. With a cyber insurance policy from Sea-Mountain, you also gain access to tools and resources designed to help you manage and mitigate cyber risks both before and after a breach occurs.

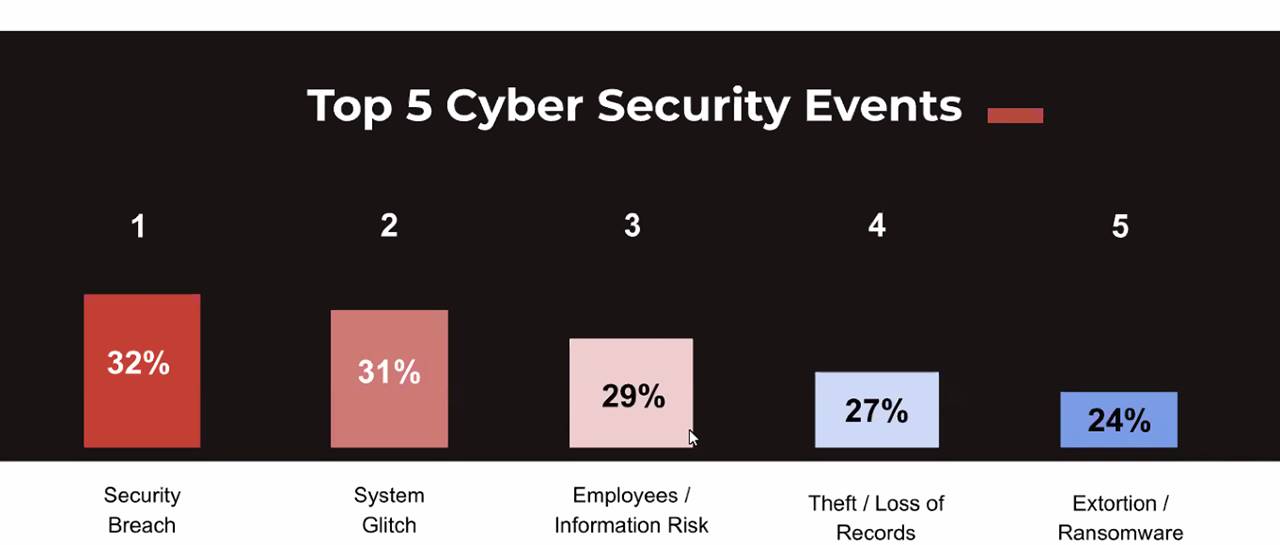

From large corporations to small local businesses, every organization that relies on technology is exposed to cyber risks. As cyber threats become more advanced, the need for protection grows. Every business should be equipped with both cyber liability insurance and a strong cybersecurity plan. At Sea-Mountain, we understand the complexity of these threats and offer tailored solutions to help protect your business and its assets.

Sea-Mountain's options provides a critical safeguard against the potentially devastating financial impact of a cyberattack. Policyholders also benefit from a range of risk management tools to strengthen their defense against cyber threats.

Cyber liability insurance helps cover expenses related to data breaches and cyberattacks. These costs may include:

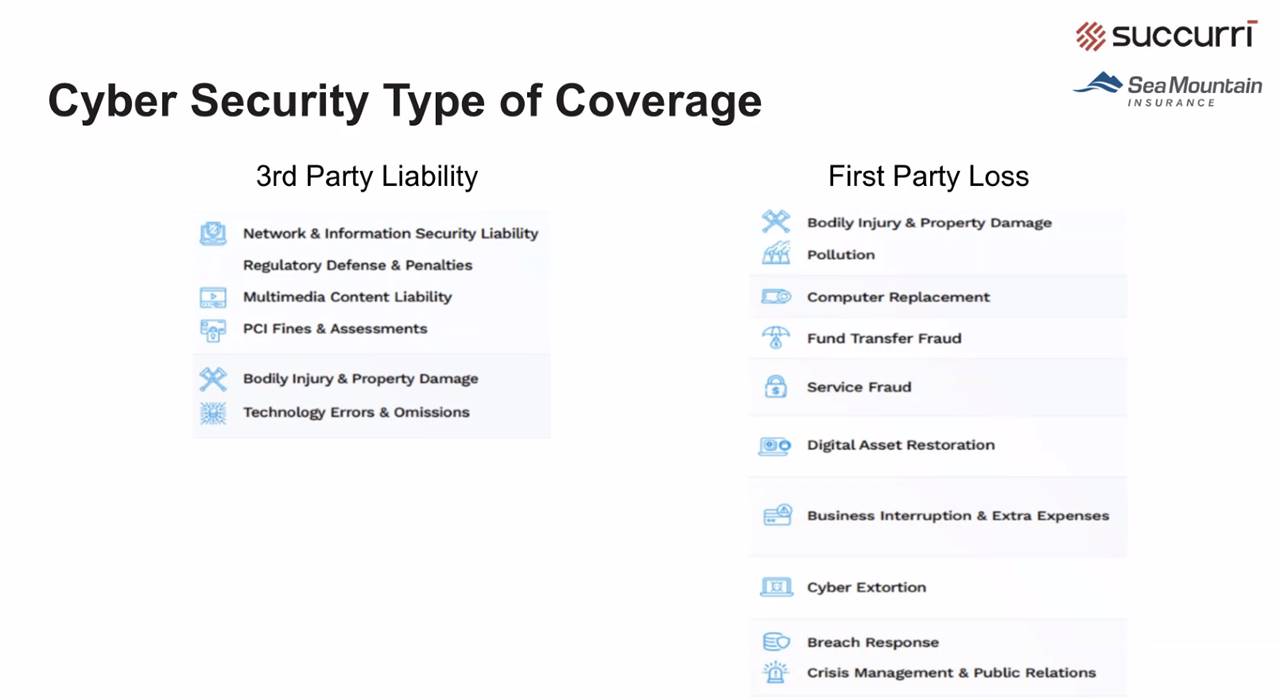

Sea-Mountain offers flexible, customized insurance solutions to match your business’s unique risk profile, with coverage options that include:

By partnering with Sea-Mountain, your business can be better prepared to navigate the challenges of a digital world.

Customers looking for Home Business Insurance also looked for the following.

Some products and services may not be available in your area.

Please contact us for more information.